ESG engagement

One of OUem’s four ESG Principles is engagement. The Oxford Endowment Fund (OEF) predominantly owns investments indirectly and as such engagement activities are carried out with investment groups, rather than through voting.

At OUem, we integrate sustainability considerations into our investment process, including during due diligence and through continued evaluation of groups following an investment decision. We have a disciplined approach to the number of active relationships with investment groups in the portfolio and an exceptionally high information flow from these groups. We maintain ongoing dialogue with groups to encourage effective sustainability and ESG risk awareness and management. This will be both on strategy specific risks and on systemic risks such as net zero, and annually through our ESG and sustainability letter. Engagement is also used to inform our own analysis and measurement of the portfolio’s sustainability.

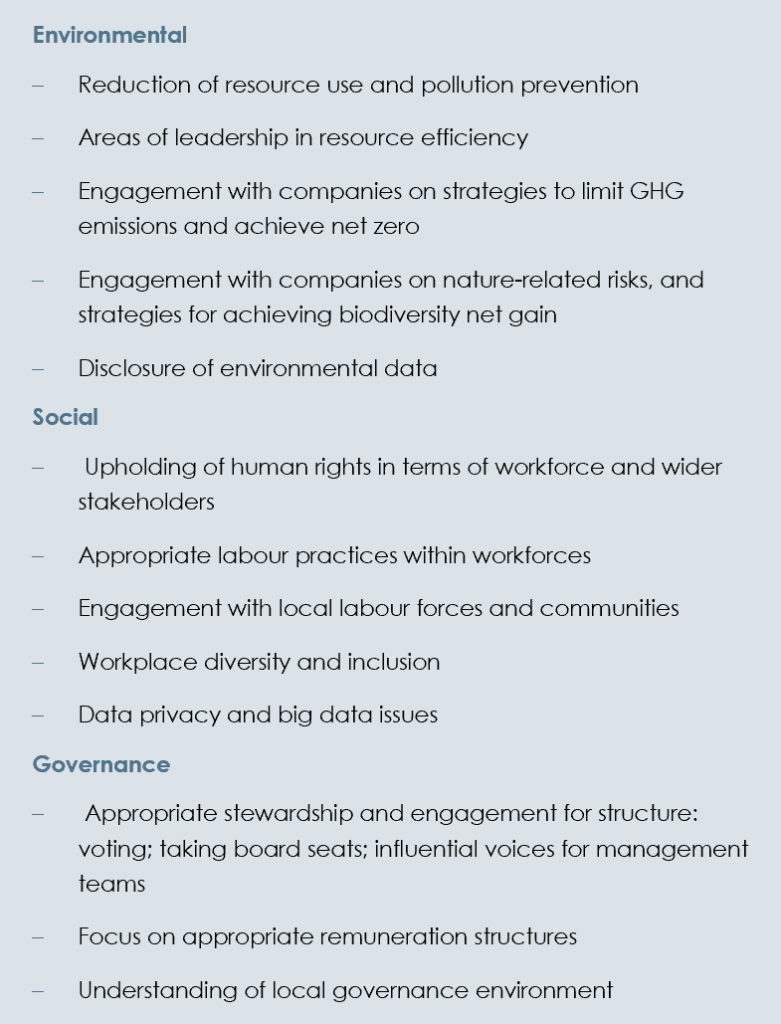

During due diligence and in ongoing engagement with investment groups, we take time to understand what risks could arise on a case by case basis. These will vary depending on the strategy; however, we may consider the following factors during our analysis:

ESG activity is registered as part of our ongoing evaluation of groups. We also have daily alerts set up to capture and notify us of any relevant ESG news from the portfolio and underlying holdings. When recording these activities, they can include: engagement with a manager on any aspect of ESG, a new ESG positive investment made by a manager, an initiative set up by a manager, ESG policy development by a manager, or a major development in an underlying holding, whether this be ESG leadership or an issue. Individual activity or engagement can therefore vary greatly in scope and scale.